Ways to Give

There are so many ways of giving and your support enables us to carry out our work. Choose the giving approach that suits you best.

Donor Advised Funds

DAFs are a fast-growing way of donating that is increasing in popularity and offers a tax-efficient approach to administering your charitable contributions. With DAFs, you can give a donation and receive an instant tax deduction.

Ayco Charitable Foundation

Bank of America Charitable Gift Fund

CharityVest

Goldman Sachs Philanthropy Fund

Greater Kansas City Community Foundation

Jewish Communal Fund

Morgan Stanley Global Impact Funding Trust (GIFT)

National Philanthropic Trust

Network for Good

New York Community Trust

Northern Trust Charitable Giving Program

Raymond James Charitable

Renaissance Charitable Foundation

T. Rowe Price Charitable

Silicon Valley Community Foundation

S. Bank Private Wealth Management

U.S. Charitable Gift Trust

Vanguard Charitable

If you don’t have a DAF, contact your financial advisor or accountant to learn more.

If you choose to include WPT in your plans, please use our legal name and federal tax ID.

Get in Touch

Nathan Schmaltz

World Parrot Trust USA, Inc.

PO Box 985, 400 S. Main St.,

Travelers Rest, SC 29690

Phone: 864-610-2129

Tax ID: 62-1561595

US Date of Incorporation: 2/28/1994

Please tell us about your gift so that we can thank you!

Not Sure What DAFs are about?

What is a donor-advised fund?

A Donor-Advised Fund (DAF) is a charitable giving method that enables donors to consolidate their giving in one place. Through a DAF program, individuals, families, and corporations can make an irrevocable charitable gift and receive an immediate tax deduction. Sponsoring organizations typically accept various types of assets, such as cash equivalents, and securities, and select other assets. This centralized approach to charitable giving can simplify the process for donors and provide flexibility in their giving strategy.

How Does it Work?

To begin, establish your DAF by making an irrevocable, tax-deductible donation to a public charity that sponsors a DAF program. Then advise the investment allocation of the donated assets (any investment growth is tax-free). And finally recommend grants to qualified public charities of your choice.

Main advantages of a donor-advised fund?

Qualified Charitable Distribution

If you are age 70½ or older and live in the United States, you can take advantage of a simple way to support parrots and receive a tax benefit in return.

By using a Qualified Charitable Distribution (QCD) from your Individual Retirement Account (IRA) — also called an IRA charitable rollover — you can make a tax-free gift to parrots through the World Parrot Trust.

The Details

Frequently Asked Questions

Example: Sue is 71 and wants to make a contribution to the World Parrot Trust. She has $100,000 in her IRA and she wants the contribution to be $5,000. She can authorize the administrator of her IRA to transfer $5,000 to the World Parrot Trust. Because the IRA Charitable Transfer is excluded from income, Sue will not be eligible for a charitable income tax deduction but she still receives tax savings. The $5,000 distributed to the World Parrot Trust will be counted toward her annual Required Minimum Distribution (RMD) and she will not pay income tax on the portion given to charity.

Next Steps

- Seek the advice of your financial advisor.

- Contact your IRA custodian and request a direct transfer to WPT at our mailing address.

- Tell us about your Qualified Charitable Distribution so that we can thank you!

Get in Touch

Nathan Schmaltz

World Parrot Trust USA, Inc.

PO Box 985, 400 S. Main St.,

Travelers Rest, SC 29690

Phone: 864-610-2129

Tax ID: 62-1561595

US Date of Incorporation: 2/28/1994

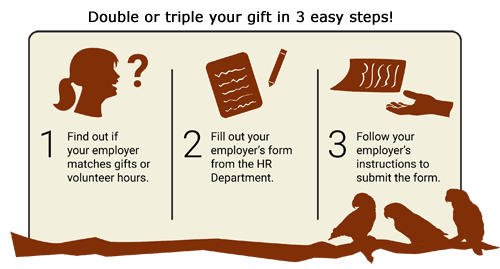

Workplace Giving Programs

Payroll Giving Programs:

Make a big impact on parrots through workplace giving programs. Hundreds of companies recognize the value of their employee’s donations by offering matching gift programs to double or triple their value.

For Employees

You can participate in your company’s giving program simply by giving small, regular donations directly from your pay. If your company participates in this kind of a program, get a Matching Gift form from your employer, fill out your portion, and mail it in the reply envelope with your donation.

Increasingly, more and more companies also offer online Matching Gift processing, so no form is required – just let them know you donated to us, and they take care of the rest. Some companies even offer donation via payroll deduction, so we receive your donation and their matching gift in one lump sum!

For Companies

Experience the excitement and fulfillment of joining a global community dedicated to preserving parrots through these impactful programs. By inspiring employee engagement and setting ambitious fundraising targets, your company can make a real difference in the lives of threatened and endangered parrots.

You can elevate workplace morale and showcase your company’s social responsibility through charity corporate partnerships – one of the most impactful ways to make a difference. Many of these charitable contributions are often tax-deductible. Many organizations often choose to match their employees’ donations dollar for dollar or with a percentage of the total donations to the World Parrot Trust.

Next Steps

Join us today to help protect these magnificent creatures and their habitats!

And please remember to let us know about your giving plans so we can express our gratitude.

Get in Touch

Nathan Schmaltz

World Parrot Trust USA, Inc.

PO Box 985, 400 S. Main St.,

Travelers Rest, SC 29690

Phone: 864-610-2129

Life Insurance

When you choose to make a gift of life insurance you are making a lasting impact towards efforts to save endangered parrots.

A gift of life insurance is for you if:

How the gift is made is up to you. Here are a couple of options to consider.

Life Insurance – WPT as Beneficiary

Name your estate as the beneficiary and include instructions in your Will to donate all or a portion of these financial assets to the World Parrot Trust. You can stipulate a specific amount or a percentage to be contributed if desired.

Note: If you choose this alternative, taxes will be withheld by your estate trustee, and probate will be applicable. In both scenarios, a charitable tax credit will be established for your estate, mitigating taxes and possibly boosting the estate value for other beneficiaries.

Life Insurance – Gift of Paid-up Insurance Policy

Designating the WPT as a Beneficiary of an Insurance Policy

With this choice you name the World Parrot Trust as primary beneficiary of your life insurance policy or as an alternate should your other beneficiaries not survive you. The benefits from your policy then pass directly to WPT.

Benefits

By taking this simple action you will gain the personal satisfaction in knowing that you are providing for the people and causes that matter most to you.

Next Steps

- Seek the advice of your financial advisor.

- Contact your policy holder and let them know about your change in beneficiary.

- Contact us to let us know of your wonderful gift so that we can thank you!

Get in Touch

Nathan Schmaltz

World Parrot Trust USA, Inc.

PO Box 985, 400 S. Main St.,

Travelers Rest, SC 29690

Phone: 864-610-2129

Securities and Stocks

A gift of stock or securities can yield a wealth of benefits for you and for the parrots.

When you give appreciated securities to the World Parrot Trust, you may receive an immediate tax benefit while diversifying your portfolio and/or securing a stream of income. Your gift of stock or mutual funds can also be used to fund a charitable gift annuity.

How It Works

When giving appreciated securities, you could receive a tax break. Whether it’s shares of blue-chip stock or a fast-growing tech company, the government may allow you to deduct these gifts as charitable donations. You may also avoid capital gains tax on the transfer.

This double benefit means that you can create a larger donation by using appreciated securities rather than cash to make your gift.

We welcome gifts of publicly traded stocks, bonds, and mutual fund shares. Some donors own stock in closely held corporations. Learn about using business assets to make a gift. The securities you use to make your gift must have been held by you for more than one year to be fully deductible.

You can also protect parrots by bequeathing equities to the World Parrot Trust in a will or estate.

Next Steps

- Transfer your securities to the WPT.

- The WPT sells the securities.

- Funds are used where they are most urgently needed.

Get in Touch

Nathan Schmaltz

World Parrot Trust USA, Inc.

PO Box 985, 400 S. Main St.,

Travelers Rest, SC 29690

Phone: 864-610-2129

Real Estate Gifts

Turn your generosity into a real and measurable impact by donating real estate to the World Parrot Trust.

Why Donate Property?

Donating real estate to the World Parrot Trust can offer you several potential benefits:

You may not have to pay tax on land or property you donate to WPT. This includes selling them for less than their market value.

Such a generous gift helps us continue our work for years to come.

Ways to Give

There are several options available for donating real estate. Two of the most common methods are:

IRS guidelines for donations involving property and real estate are available here.

Next Steps

Get in touch with us now to learn more about how you can use any of these options. We would be delighted to help your attorney and other financial advisors in creating the best plan for you.

Get in Touch

Nathan Schmaltz

World Parrot Trust USA, Inc.

PO Box 985, 400 S. Main St.,

Travelers Rest, SC 29690

Phone: 864-610-2129

Foundations / Charitable Trusts

Grants play an essential role in enabling us to care for the parrots in our rescue centers, fighting for legislative changes in the wildlife trade, aiding front-line partners, and educating parrot owners to create a better world for parrots.

Why support WPT?

Nearly 1 in 3 species of parrots are under threat in the wild. Thousands are annually caught in the unsustainable wildlife trade and millions are kept as pets. Parrots are in need of our help to protect them and their habitats, and to ensure their survival into the future.

Since 1989, the World Parrot Trust (WPT) has been a steadfast advocate for parrot conservation, striving to protect parrots at all levels, from local communities to the global arena, and putting in tireless efforts to reverse the trend of extinction.

What We Can Offer You

We work with trusts, foundations and philanthropists to create a personal experience that benefits us all. We have a range of projects to suit individual interests, to ensure that you are as passionate as we are about protecting our parrots.

Your giving experience matters to us. That’s why we offer personalized options that cater to your unique needs, whether you want to support all our work or have a specific project or species in mind.

Stay connected to the incredible impact of your gift with regular updates and photos from our ground-based conservation partners. We ensure you’re always up-to-date on how your contribution is making a difference in protecting our planet’s biodiversity.

We work to connect trusts, foundations and philanthropists with communities to build long-lasting relationships, through which we can create effective and sustainable change to protect parrots.

Next Steps

If you are a trustee, or have links with a Charitable Trust or Foundation and are interested in our work, please get in touch with us.

We will work with you to find the right project to meet your philanthropic objectives.

Get in Touch

Nathan Schmaltz

World Parrot Trust USA, Inc.

PO Box 985, 400 S. Main St.,

Travelers Rest, SC 29690

Phone: 864-610-2129

Gifts in Kind

Transform your generosity into tangible impact through in-kind donations, the non-monetary contributions made to the World Parrot Trust. Elevate your giving beyond traditional monetary contributions with the transfer of any asset, such as goods or services, and join individuals, organizations, and companies in making a lasting difference.

How it Works

In-kind donations generally take two different forms:

Benefits

Your contribution may be tax deductible so please check with an investment advisor or estate planner to make sure that you receive the maximum benefit to which you are entitled.

You can be confident that the World Parrot Trust is committed to maintaining the privacy and confidentiality of your personal information.

Next Steps

- The process begins with you contacting us about the item or service to be donated.

- After the fair market value is determined, a release is signed to transfer the objects to WPT or to confirm the value of the services.

- WPT receives the goods or services and you receive charitable receipt.

Note: not all items will be able to be accepted

Get in Touch

Nathan Schmaltz

World Parrot Trust USA, Inc.

PO Box 985, 400 S. Main St.,

Travelers Rest, SC 29690

Phone: 864-610-2129